"Providing loans to non-store online operators without sales."

[Infostock Daily = Reporter Kim Jong Hyo] “Naver has been helping users who can be alienated from information through the value of ’connection’ to meet various information and offline sellers who have not found a market and creators who are not usually noticed to meet more diverse users.”

“Naver Financial’s finance is also on the line of extension of Naver’s ‘value of connection’,” said Choi In-hyuk, CEO of Naver Financial.

◇"Building its own ACSS to support SME without financial history... Reflecting real-time sales flow of sellers"

Naver Financial unveiled its business direction and major services it is preparing for through the ‘Naver Service Meetup’ event on the 28th.

“It is Naver’s big direction to create new value in the financial market with services that can cover financial marginalized groups such as SME(Small and Medium-sized Enterprise) and Thin Filers, which had to remain in blind spots due to lack of financial history,” Choi said. “We will focus on financial services for SME, which is Naver’s most important partner and the foundation of our social growth.”

Naver's direction is to increase the value of ‘connection’ with technology and data and to help the growth of SME and creators.

According to Naver, 67% of sellers who start online business through Naver Smart Store, a tool that helps them easily start online business, were in their 20s and 30s. Most of them are classified as Thin filer with insufficient financial history, and it is the most difficult situation to finance at the stage of starting and raising the business.

Those classified as Thin Filer have difficulty in lending even if they borrow from the existing financial sector due to low limits or very high interest rates. Online sellers, especially those without stores, are often excluded from loans.

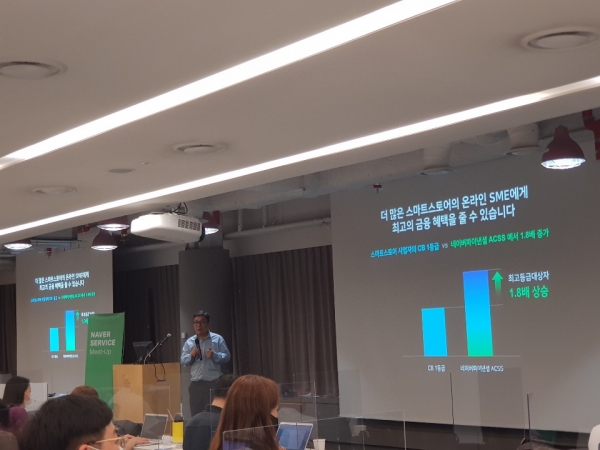

Choi said, "We are building Naver Financial's ACSS(Alternative Credit Scoring System) for financial services for such SME." Compared to existing financial institutions that judge whether to borrow based on sales, taxes, and store size, Naver Financial applies sales flow and seller reliability of smart store sellers to ACSS in real time, sellers will also be able to get opportunities to use financial services. "

◇"The settlement date is 5.4 days, greatly shortened... rapid settlement and SME loan program plan to open this year"

“In order to support smart store sellers with little financial information, we needed alternative data to evaluate their credit ratings and a new credit rating system based on them,” said Dr. Kim Yu-won of Naver Data Lab in charge of ACSS deployment. "To this end, we added real-time revenue streams of sellers to the financial data of existing credit rating companies(CB, Credit Bureau) and established our own ACSS by utilizing Naver's latest machine learning algorithm, AI, and big data processing technologies."

Simulation of Naver Financial's ACSS shows that the number of first-class subjects is almost twice as high as the existing CB grade. If the data is accumulated, the ACSS will be upgraded and more SME will be supported in the future.

Based on this technology, Naver Financial plans to open 'SME Loans' and 'Fast Settlement' programs within the year in addition to 'Quick Escrow' and 'Start Zero Fee Program' that have been provided for SME.

The ‘SME loan’, which Naver Financial prepares with Mirae Asset Capital, is characterized by: △that companies with no financial history can receive loans at the interest rate of the banknote level, △the approval rate and limit are high due to the loan review using business information for the first time in the industry, △that if there is no store or no income, it can apply for a certain amount of sales at Naver Shopping, △If you have your own mobile phone, you can easily check the limit and interest rate in one minute.

In addition, Naver Financial plans to significantly shorten its settlement date from 9.4 days to 5.4 days to help sellers spin their business funds quickly. It is an extraordinary schedule compared to the settlement cycle of other open markets ranging from 10 to 11 days.

The FDS(Fraud Detection System) that Naver has built, detects the risk of the sellers who may have problems in advance, and changes the structure from 'Settlement after Purchase' to 'Settlement after delivery' to accelerate the settlement date.

“Naver’s support infrastructure for SME’s start-up and growth has been completed, from smart store-based start-ups to education at Naver Partner Square, support for various technologies and data such as Biz Advisors and funding,” Choi said. “As part of this effort, Naver Financial will do its best to help SME concentrate on its business without worrying about funds.”

Reporter Kim Jong Hyo kei1000@infostock.com