[Infostock Daily= Reporter Park Sang-In] Daishin Securities raised its target price from 19,000 won to 31,000 won on the 29th, saying that it is currently winning 22 out of 88 orders on the roadmap of hydrogen charging stations. The investment opinion is BUY (buy).

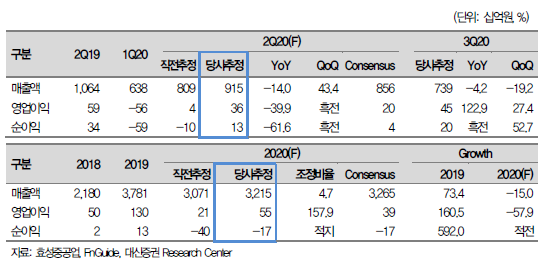

Hyosung Heavy Industries recorded sales of W915bn and operating profit of W35.6bn in 2Q08, exceeding 7% and 82.6% of consensus sales of W855.5bn and operating profit of W19.5bn, respectively.

![[Data = Daishin Securities Provide]](/news/photo/202006/99390_53774_2937.png)

“Hyosung Heavy Industries’ stock price rose 59.7% in June due to hydrogen momentum,” said Dong-heon, a researcher at Daishin Securities. “We started hydrogen-related projects in early and mid-2000, and we have a lot of experience in it, and we are expecting to collaborate with the Linde Group in Germany.” "We expect about 300 hydrogen filling stations to be ordered by 2022," he said.

“The company has 2 to 3.5 billion won per site, and 100 billion won in annual sales will be reflected in the assumption of maintaining market share,” he added.

On the other hand, sluggish investment in the front industry is still continuing, it is an evaluation that it should be noted that mid- to long-term turnaround is starting after the restructuring is completed.

Reporter Park Sang-In si2020@infostock.co.kr