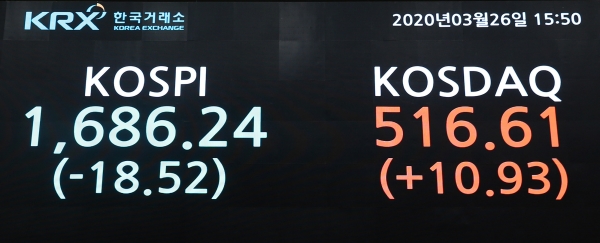

[Infostock Daily= Reporter Park Hyo-sun] The KOSPI index fell 18.52 points (▼1.09%) from the previous trading day to close at 1686.24 on the 26th.

The Bank of Korea announced an unlimited liquidity supply policy, followed by the US Congress, which rose 1 percent on news that the largest stimulus bill ever passed.

But it did not help restore investor sentiment. Foreign investors reacted and the sell-off continued as the US futures market fell in the afternoon.

According to the Korea Exchange, the KOSPI started at 1,699.11, down 5.65 points (▼0.33%) from the previous day. The index grew its decline in the afternoon, repeating the rise and fall.

In the KOSPI market, individual investors net bought 716.4 billion won.

Foreign investors, on the other hand, sold 534.6 billion won and institutional investors sold 213.9 billion won, while foreign investors continued to sell for 16 consecutive trading days.

By industry, electrical and electronics (▼2.16%) and chemicals (▼1.10%) fell while paper wood (▲3.60%), medical precision (▲1.95%), and transportation warehouses (▲1.04%) rose.

In the top market cap, all but Hyundai Motor (▲0.47%) fell.

SK Hynix (▼4.5%), Samsung Bio Logics (▼3.89%), LG Chem (▼2.60%), LG Household & Health Care (▼2.59%), NAVER (▼2.24%), Samsung SDI (▼2.18%), Samsung Electronics (▼1.75%), Celltrion (▼0.82%) fell.

The KOSDAQ closed at 516.61, up 10.93 points (▲2.16%) from the previous trading day.

The KOSDAQ index opened 0.83 points (▲0.16%), to 506.51, turning to a decline in early trading, but it has since recovered.

In the KOSDAQ market, individual investors net bought 159.8 billion won, while foreign investors sold 89.7 billion won and institutional investors net sold 689.2 billion won.

By industry, pharmaceuticals (▲6.60%), construction (▲5.70%), textile apparel (▲4.24%), transportation (▲3.61%), finance (▲3.41%), paper wood (▲2.43%), etc. rose sharply.

In the top-tier market cap, Seegene (▲29.97%) posted the upper limit for two consecutive trading days; Celltrion Pharmaceutical (▲6.80%) also rose sharply.

Celltrion Healthcare (▼1.64%), HLB (▼2.18%), Pearl Abyss (▼2.02%), Studio Dragon (▼1.16%), CJ ENM (▼0.50%), KMW (▼3.11%), Hugel (▼3.11%), SK Materials (▼2.84%) fell.

The won-dollar exchange rate in the Seoul foreign exchange market rose 2.9 won (+0.2 percent) to 1232.8 won per dollar.

Reporter Park Hyo-sun hs1351@infostock.co.kr