"If the Samsung Life Insurance Preferential Act (for the Lees) is revised, tax revenues, including transfer taxes and corporate taxes, can be be increased by 10 trillion won."

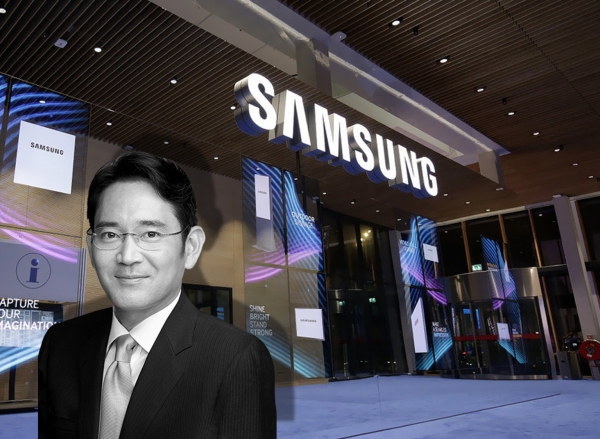

As Hong Ra-hee, Lee Jae-yong, Lee Boo-jin and Lee Seo-hyun inherited shares of Samsung Life Insurance owned by the former Chairman Lee Kun-hee, the Lees further strengthened their controls for Samsung Electronics. Even if the Lee's family stake in Samsung Electronics is only 5.79%, but they have absolute power over the entire Samsung Group.

Such unusual governance structure is possible because of cross-share holding structures: Vice Chairman Lee Jae-yong → Samsung C&T → Samsung Life → Samsung Electronics. The key entity of Samsung Group's governance structure is Samsung Life Insurance and the current Insurance Business Act benefitting Samsung Insurance is one of the pivotal requirements for the structure.

Recently, the revision of the Act has been drawing keen attention as it has been actively discussed by the National Assembly and civic groups.

<Infostock Daily> prepared a series of articles that comprehensively reviews deficiencies of the Samsung Group's governance structure based on the current Act and its impact on the market with a member of the National Assembly Lee Yong-woo, who proposed a partial amendment to the Insurance Business Act on June 18 last year.

◇ In the Samsung Life Insurance Preferential Act, there is no ‘fair price’ rules.

In Korea, the principle that financial companies should not be used to control group affiliates based on the principle of separation of financial and industrial capital is recognized as the golden rule.

The current insurance act clearly defined the investment limit of affiliates. For example, the Insurance Business Act stipulates 3% of the total assets, 8% of the Capital Market Act's equity capital, and 10% of the banking law's equity capital.

The investment limit of affiliates is compared to the total assets and it is divided into the acquisition cost in the past and the market price in the present. In most countries, including Korea, market transaction prices are strictly evaluated as 'fair prices'. During the 1998 financial crisis, the IMF could not assess the financial status based on the acquisition cost.

"For example, If the company' acquisition cost was KRW 5,000 in the financial statements and the current market price has grown to KRW 100,000, the company has performed well. On the contrary, If the current market price is KRW 1,000 when the acquisition cost is KRW 5,000, the the company is struggling financially." said the Assembly man Lee.

For this reason, IMF demanded the change of capital markets and banking laws to be calculated at market costs. As a result, the insurance supervision regulation has been changed to "Market costs is a basis when calculating the stock investment limit of affiliates."

All capital market laws were updated to fair price method except for the insurance industry. At that time, Samsung Life Insurance's ownership of Samsung Electronics easily exceeded 3%. That is why the current Insurance act is called as Samsung Life Insurance Act, benefiting the Lee's family greatly. Currently, Samsung Life Insurance has an excessive stake of 8.51% (58,157,148 shares) in Samsung Electronics.

If the National Assembly passes the amendment ... The Korea government can secure at least 10 trillion won in tax revenue

In June last year, The Assembly men Park Yong-jin and Lee Yong-woo insisted that the revision of the Insurance Business Act should be passed as soon as possible as they proposed the revision of the Act respectively.

Samsung Electronics and Samsung Life Insurance are bound to be on edge over the revision of the insurance law pending at the National Assembly. In a recent statement, the Citizens' Coalition for Economic Justice urged, "Samsung Life's preferential treatment was made under Chairman Lee Kun-hee, and if Samsung does not resolve it on its own, the National Assembly should return it normally through a revision of the law.".

Samsung Electronics, Samsung Life Insurance, and Samsung Fire & Marine Insurance are not only violating the principle of separation of industrial and financial capital, but also provide preferential treatment to Lee's family under the provisions of the industrial and financial capital Act in 2006. The Lees are also receiving preferential treatment in the Insurance Business Act. If the Insurance Business Act is revised, Samsung Life Insurance will have to sell its stake in Samsung Electronics, which is 5.51% and about 31 trillion won.

"If the Insurance Business Act is revised, Samsung Life Insurance have to sell about 30 trillion won worth of Samsung Electronic shares. From this sales transaction, 5 trillion won transfer tax and 5 trillion won corporate tax will be collected," said Cho Ho-jin, CEO of Takeon World.

"There are about 2 million Samsung Life Insurance customers whom are eligible to receive dividends. Each customers will receive about KRW 2 million if the sale is finalized," he added. "As Samsung Life Insurance receive customers' insurance premiums and makes profits, the company is responsible to share profits with its customers. If the sale is finalized, Samsung Life Insurance has to pay KRW 10 trillion in taxes, and the remaining KRW 29.4 trillion will be shared by the company and policyholders."

The National Assembly and financial authorities are taking same stance on the revision of the Act. Park Yong-jin, a National Assembly man of the Democratic Party of Korea, is steadily expressing the need of passing the revision of the Insurance Business Act during the 21st National Assembly. The Financial Services Commission is also pointing out problems related to Samsung Group several times and calling for improvement.

Reporter Lee Ji-sun stockmk2020@gmail.com