Exchange, The Development of 'Carbon Efficiency Green New Deal Index'

[Infostock Daily= Reporter Park Hyo-sun] The Korea Exchange will announce five types of 'KRX BBIG K-New Deal Index', which consists of leading companies that can drive the paradigm shift of the Korean economy, from the 7th.

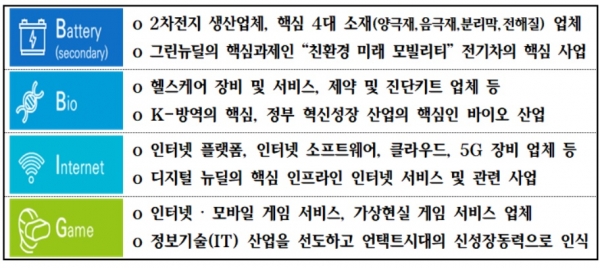

The five types of the KRX BBIG K-New Deal Index are divided into the △KRX BBIG K-New Deal Index △KRX secondary battery K-New Deal Index △KRX bio K-New Deal Index △KRX Internet K-New Deal Index △KRX game K-New Deal Index.

First of all, the △KRX BBIG K-New Deal Index will consist of 12 leading companies in South Korea's BBIG industry, including LG Chem, Samsung Biologics, Naver and NCSOFT.

△KRX secondary battery K-New Deal Index including LG Chem, Samsung SDI, SK Innovation, etc. △KRX bio K-New Deal Index including Samsung Biologics, Celltrion, SK Biopharm, etc. △KRX Internet K-New Deal Index including Naver, Kakao, Douzone Bizon, etc. △KRX game K-New Deal Index including NCSOFT, Netmarble, Pearl Abyss, etc. Each contains 10 items like this.

The combined market capitalization of 10 major stocks in the BBIG(battery ‧ bio ‧ Internet ‧ game) industry, a key area of the K-New Deal policy, is 322 trillion won, accounting for 20.4%(as of the end of August) of the KOSPI.

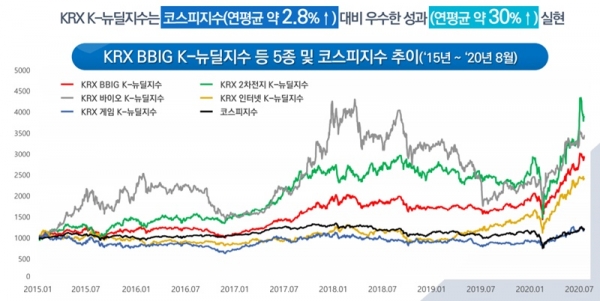

In particular, over the past five years since 2015, the average annual yield of the five KRX BBIG K-New Deal indexes has been around 30%, 10 times higher than that of the KOSPI, which is around 3%.

In order to materialize the Korean version of the New Deal comprehensive plan vision, the exchange has recently developed the K-New Deal index by selecting the BBIG industry, which has been in the spotlight as a future growth-driven industry.

"After the announcement of the KRX BBIG K-New Deal Index, we will push for an early listing of ETF next month so that market funds can flow into the capital market," the exchange said, adding, "Among 40 blue-chip stocks, 19 KOSDAQ stocks will be selected, contributing to raising interest in the KOSDAQ market and revitalizing the market."

The exchange is also seeking to develop a 'Carbon Efficient Green New Deal Index'.

"In order to induce companies to convert their business environment to eco-friendly ‧ low-carbon bases, we are scoring industrial characteristics and carbon emissions per unit of sales, and developing them to increase the proportion of investment by companies with high carbon efficiency scores," the exchange said.

Reporter Park Hyo-sun hs1351@infostock.co.kr